Financial Wellness Empowering Your Journey for Life

Financial Wellness Resources to Differentiate Your Organization, Increase Productivity and Reduce Turnover with Employees and Clients!

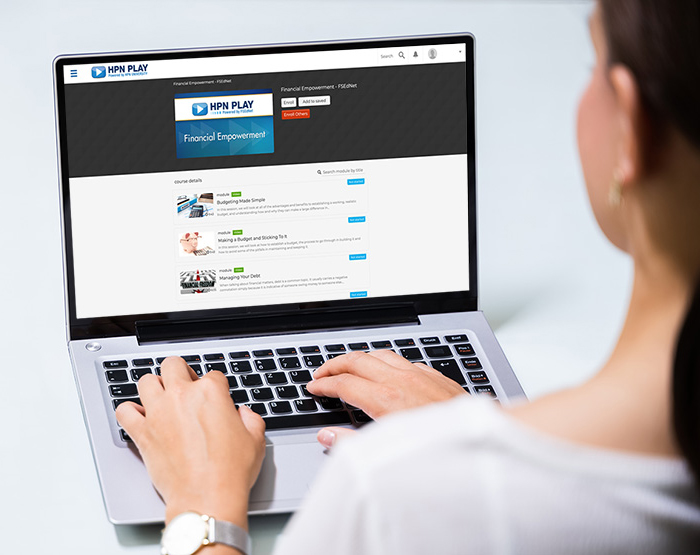

Organizations across all verticals are becoming increasingly aware of the need to increase financial wellness and empowerment among their employees and clients. Studies show doing so has many advantages from increased productivity to greater job satisfaction, to lower employee and client turnover.

Financial Wellness Digital Content Library Features Approximately 200 Learning Modules in the Following Areas and More:

Over 50 Financial Calculators, Extensive Video Library and Over 700 Articles for Financial Wellness:

Our Financial Wellness Digital Content Is Designed To Be Used With the Following Types of Groups:

Financial Wellness Content Designed for Schools and University Students!

Our platform has the tools and resources that are specifically designed to help educate students on reaching their financial goals, improving their financial literacy and to help them make the right financial decisions.